At MitonOptimal we take asset allocation (AA) very seriously, taking into consideration both Strategic AA (3-7 years) and Tactical AA within the various asset classes. This quarterly piece provides insight into our short term tactical calls on a 12-month view (reviewed quarterly) and as such may diverge from our long term strategic AA views. We review our strategic AA bi-annually as we believe this is prudent practice, in a world dominated by debt de-leveraging, central bank and political interference.

|

Index |

Q1 2023 |

2023 |

|

FTSE/JSE Capped SWIX All Share TR ZAR |

2.44 |

2.44 |

|

FTSE/JSE SA Listed Property TR ZAR |

-5.05 |

-5.05 |

|

FTSE/JSE All Bond TR ZAR |

3.39 |

3.39 |

|

FTSE/JSE ALB 1-3 YrTR ZAR |

2.40 |

2.40 |

|

Allan Gray Money Market |

1.81 |

1.81 |

|

MSCI World NR USD |

12.34 |

12.34 |

|

MSCI EM NR USD |

8.40 |

8.40 |

|

GinsGlobalGlobal Bond Index |

7.12 |

7.12 |

|

OMG Money Market USD |

5.39 |

5.39 |

|

S&P Global REIT TR USD |

6.00 |

6.00 |

|

Bloomberg Commodity TR USD |

-1.31 |

-1.31 |

|

STeFIComposite ZAR |

1.75 |

1.75 |

|

S&P 500 NR USD |

11.95 |

11.95 |

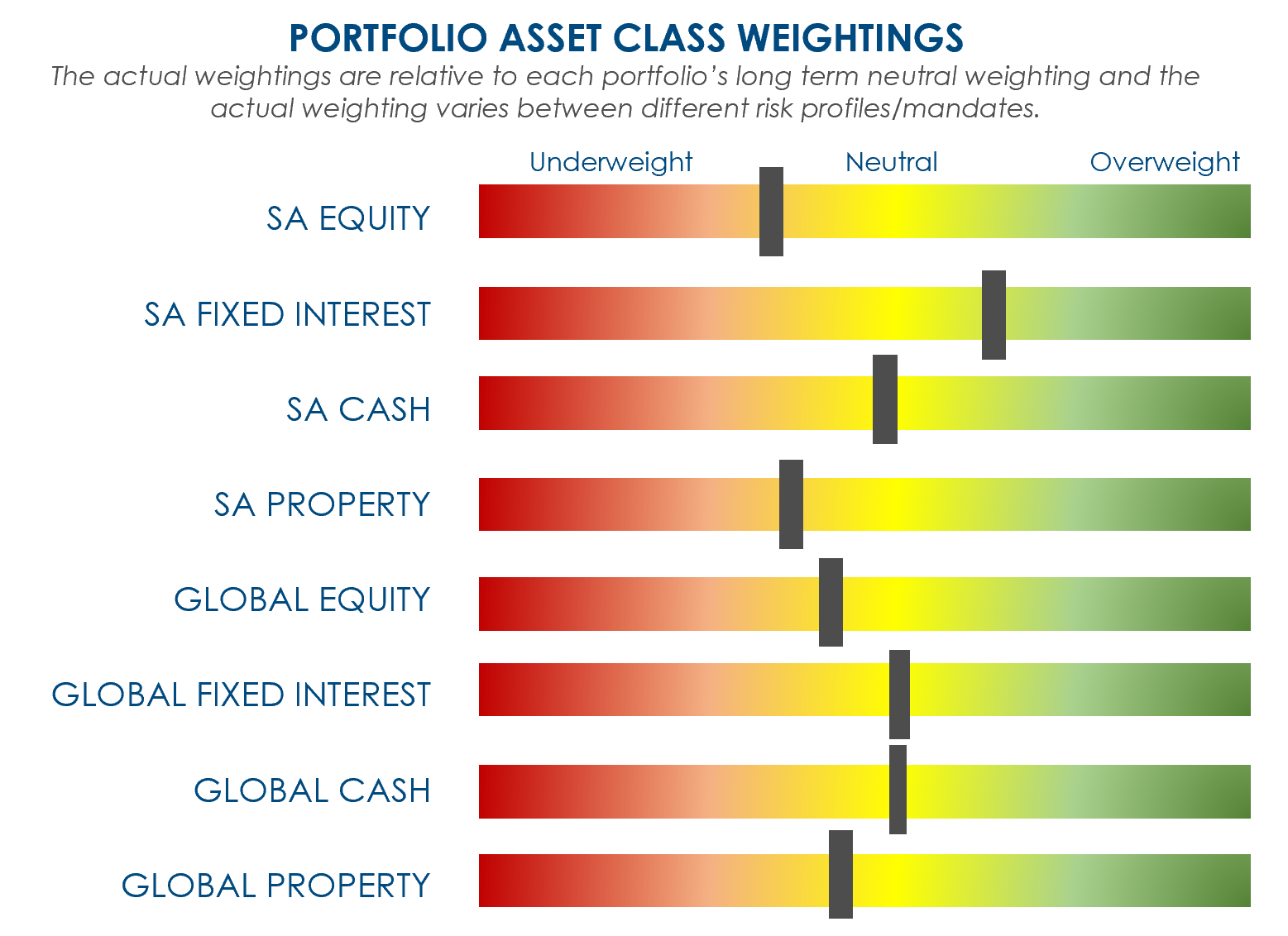

SA EQUITY

UNDERWEIGHT – NEUTRAL PERFORMANCE

The first quarter of 2023 saw local equities return positive numbers of varying size depending on the index. This is because Naspers and Richemont were by far the outperformers over this period and influenced relative returns to a large extent. The beta index we use, FTSE/JSE Capped SWIX All Share, returned 2,44% over this period, slightly underperforming the ALBI and grossly underperforming global equities. This contrasts with the FTSE/JSE All Share Index that returned 5,17% over the same period, because of higher Naspers and Richemont exposure.

It seems like global inflation figures have turned the corner, more so than in South Africa. A global recession is still weighing on the minds of investors and federal banks alike.

This put a heavy burden on the financial sector (especially banks) in the wake of the downfall of SVB and Credit Suisse. But it was the resources sector that was the biggest detractor (-4,42%) with Industrials the best sector for the quarter returning 14,51%.

These factors as well as ZAR weakness, pushed us to reduce local equity at the start of the quarter into an underweight allocation. Although the Capped SWIX Index underperformed versus the ALSI, our underweight allocation was not a detractor to performance as much as the underweight to Naspers and Richemont.

SA LISTED PROPERTY

UNDERWEIGHT – UNDERPERFORM

The sector had a troublesome start to the year in contrast to the last quarter of 2022. Although fundamentals for many of the REITS in the sector are looking strong after a horrid 2020, the lack of GDP growth, continuous loadshedding and rising interest rates, is putting tremendous pressure on the sector.

This caused us to move from neutral to slightly underweight the sector with the idea to move in more aggressively when interest rates level out and start to recede.

SA FIXED INTEREST

OVERWEIGHT – NEUTRAL PERFORMANCE

With the FTSE/JSE All Bond returning 3,39% and FTSE/JSE ALB 1-3 Year doing 2,4%, it had a neutral effect on our portfolios and funds. We are still seeing value in the medium end of the curve without taking too much risk by going into the long end. With many risks on local bonds, especially with the 2024 elections around the corner, our risk appetite is lower than a few months ago. Foreign investment outflows are also influencing bond prices negatively and could continue for a while.

It remains to be seen how the SARB rate decision will be affected by current inflation and growth prospects and will have the biggest impact on bond prices over the short to medium term.

SA CASH

NEUTRAL – UNDERPERFORMED

Our neutral exposure to cash was a detractor to the performance of our funds and relatively speaking, with the STeFI Composite Index returning 1,75%, behind equities and the ALBI. We did see a move from cash to bonds in our portfolios and did benefit from that, but our overall exposure to SA Cash was a detractor of relative performance.

GLOBAL EQUITIES

UNDERWEIGHT – OUTPERFORMED

Global markets remained volatile this quarter, as growth and inflationary concerns continue to wreak havoc. This sparked conversations about, when, rather than if a global recession is on the cards for global markets. Although the FED seems to have inflation under control with US CPI hitting a low of 7,1% (year-on-year) in February, it’s still too early to call the FED turning dovish.

After our investment committee meeting early in February, we preferred global risk assets to local risk assets and moved the portfolios accordingly. The risks inherent in our local market and pressure on the ZAR had the biggest influence on this decision. Overall, however, we remained underweight risk assets and that included global equities.

Over the quarter, the ZAR weakness had the biggest impact on global equity performance, weakening by 4,28% versus the US Dollar and adding that return to any global asset class. This meant the MSCI World Index was up 12,34% and the MSCI EM Index contributed 8,4% in returns for the quarter (all in ZAR terms).

GLOBAL PROPERTY

UNDERWEIGHT – OUTPERFORMED

With the ZAR weakening over the quarter, the boost to global property performance pushed it into “outperforming” territory. The S&P Global REIT Index returned 6% in ZAR terms, outperforming both local equity and local bonds but underperformed versus global equities.

With risks to the downside still present in the risk-off environment, we remain underweight the sector. But where we do own global listed property, we are focused on sectors such as warehousing, storage, data centres and infrastructure. Our view is that future interest rate cuts could benefit the sector and we would up our allocation in such an event.

GLOBAL FIXED INTEREST

NEUTRAL – OUTPERFORMED

With global interest rates still very low relative to history and inflation on the rise, we have been sceptical on Global Fixed Interest for quite a while. This scepticism reduced as bond yields started to flatten and reverse and we moved to a neutral allocation during the quarter. The ZAR weakness added to the relative performance of the asset class with the Global Bond Index up 7,12% for the first quarter of the year.

With global yields ticking up slightly and the outlook seeming more positive with the FED hiking cycle seemingly coming to an end, we might be inclined to add some allocation in the near future. But this all depends on future interest rate calls, which has been very difficult to predict over recent history.

GLOBAL CASH

NEUTRAL – NEUTRAL PERFORMANCE

As with local cash exposure, the global cash allocation is used as either a risk mitigator or as a place holder for future deployment into risk opportunities. We moved from underweight to neutral exposure since Q4 2022 and in some cases slightly overweight. There are still many risks that we fear could play out over the medium term and we are therefore cautious on our risk asset allocations.

We feel confident in maintaining a neutral to overweight exposure into Q2, using Global Cash as a risk mitigation tool when and where appropriate.

All data sourced from Morningstar

DOWNLOAD: QUARTERLY MARKET INSIGHTS: Q1 2023

Jacques de Kock

Quantitative Analyst & Portfolio Manager

The content of this article is for information purposes only and does not constitute an offer or invitation to any person. The opinions expressed are subject to change and are not to be interpreted as investment advice. You should consult an adviser who will be able to provide appropriate advice that is based on your specific needs and circumstances. The information and opinions contained herein have been compiled or arrived at from sources believed to be reliable and given in good faith, but no representation is made as to their accuracy, completeness or correctness. MitonOptimal South Africa (Pty) Limited is an Authorised Financial Services Provider Licence No. 28160, regulated by the Financial Sector Conduct Authority (FSCA) – Registration No. 2005/032750/07.MitonOptimal Portfolio Management (Pty) Limited is an Authorised Financial Services Provider Licence No. 734, regulated by the FSCA – Registration No. 2000/000717/07.