At MitonOptimal we take asset allocation (AA) very seriously, taking into consideration both Strategic AA (3-7 years) and Tactical AA within the various asset classes. This quarterly piece provides insight into our short term tactical calls on a 12-month view (reviewed quarterly) and as such may diverge from our long term strategic AA views. We review our strategic AA bi-annually as we believe this is prudent practice, in a world dominated by debt de-leveraging, central bank and political interference.

|

Index |

Q3-2025 |

Q2-2025 |

|

FTSE/JSE All Share |

12,88 |

10,15 |

|

FTSE/JSE SA Listed Property |

6,65 |

9,12 |

|

FTSE/JSE All Bond |

6,94 |

5,88 |

|

STeFI Composite |

1,81 |

1,86 |

|

MSCI World |

4,14 |

7,71 |

|

MSCI EM |

7,41 |

8,21 |

|

S&P 500 |

4,87 |

7,09 |

|

S&P Global REIT |

1,45 |

-0,42 |

|

GinsGlobal Global Bond Index |

-3,48 |

0,90 |

|

Bloomberg Commodity |

0,62 |

-6,35 |

|

USD Money Market |

-1,95 |

–2,40 |

Source: Morningstar in ZAR

Q3 2025 unfolded as a defining quarter — markets rallied on hopes of disinflation, dovish pivots by Central Banks, and renewed investor appetite for growth amid stretched valuations. The narrative of the quarter was shaped by three central threads:

- slowing inflation and Central Bank divergence;

- a resurgence in emerging markets and commodities;

- and the persistence of structural and late-cycle risks.

Core inflation cooled, giving developed market Central Banks room to pivot sooner, though with caution. The US and Europe eyed rate cuts, while emerging markets navigated a more nuanced path. A softer Dollar, improving external accounts, and attractive valuations underpinned a robust comeback in EM equities and commodity-linked assets. Despite optimism, challenges persisted — fiscal pressures, geopolitical frictions, and late-cycle vulnerabilities in credit and real assets tested sentiment. Against this backdrop, MitonOptimal maintained a barbell orientation — overweight equities (especially in EM) and cash, underweight core bonds — while leaning selectively into commodity and yield opportunities.

Global Market Overview (USD Terms)

The third quarter of 2025 saw a notable shift in global sentiment as inflation data trended lower and Central Banks across major economies signaled an end to their tightening cycles. Markets responded positively to the prospect of rate cuts, with expectations building for around 100 basis points of easing from the Federal Reserve over the following 12 months. Global growth remained uneven, with the United States buoyed by resilient consumer spending and AI-driven investment, while Europe lagged slightly amid sluggish manufacturing activity. Equity markets advanced broadly, driven by solid corporate earnings and a rotation from mega-cap dominance toward smaller, cyclical, and value-oriented names. Emerging markets benefited the most from this environment, as a softer Dollar and improving risk appetite fueled one of the strongest EM rallies in over a decade. Bond markets were more muted, delivering mixed returns as yields moved lower in developed markets but credit spreads widened in certain regions. Commodities provided modest gains, supported by demand from industrial metals and energy, though agricultural prices remained volatile.

South African Market Overview (ZAR Terms)

On the local front, South African assets delivered robust performance through the third quarter, supported by stable inflation, a stronger Rand, and improving investor sentiment. Inflation peaked modestly in July at 3.5%, before easing back to 3.3% in August, comfortably within the South African Reserve Bank’s 3–6% target range. The SARB’s decision to lower the repo rate to 7.00% in July provided a supportive backdrop for bonds and equities, while the September meeting maintained a pause, signaling a measured approach to future easing. Domestic growth remained subdued but slightly improved, with forecasts revised upward to around 1.2% for 2025 as energy supply and business confidence stabilised. South African equities rallied strongly, rising 12.9% in ZAR terms and outperforming global peers, driven by renewed inflows into emerging markets and a rotation into cyclicals and resource-linked counters. Listed property also strengthened, gaining 6.6%, while bonds advanced nearly 7% as yields compressed across the curve. The Rand held firm against the Dollar for most of the quarter, reflecting a stable macro backdrop and improving investor confidence in local assets.

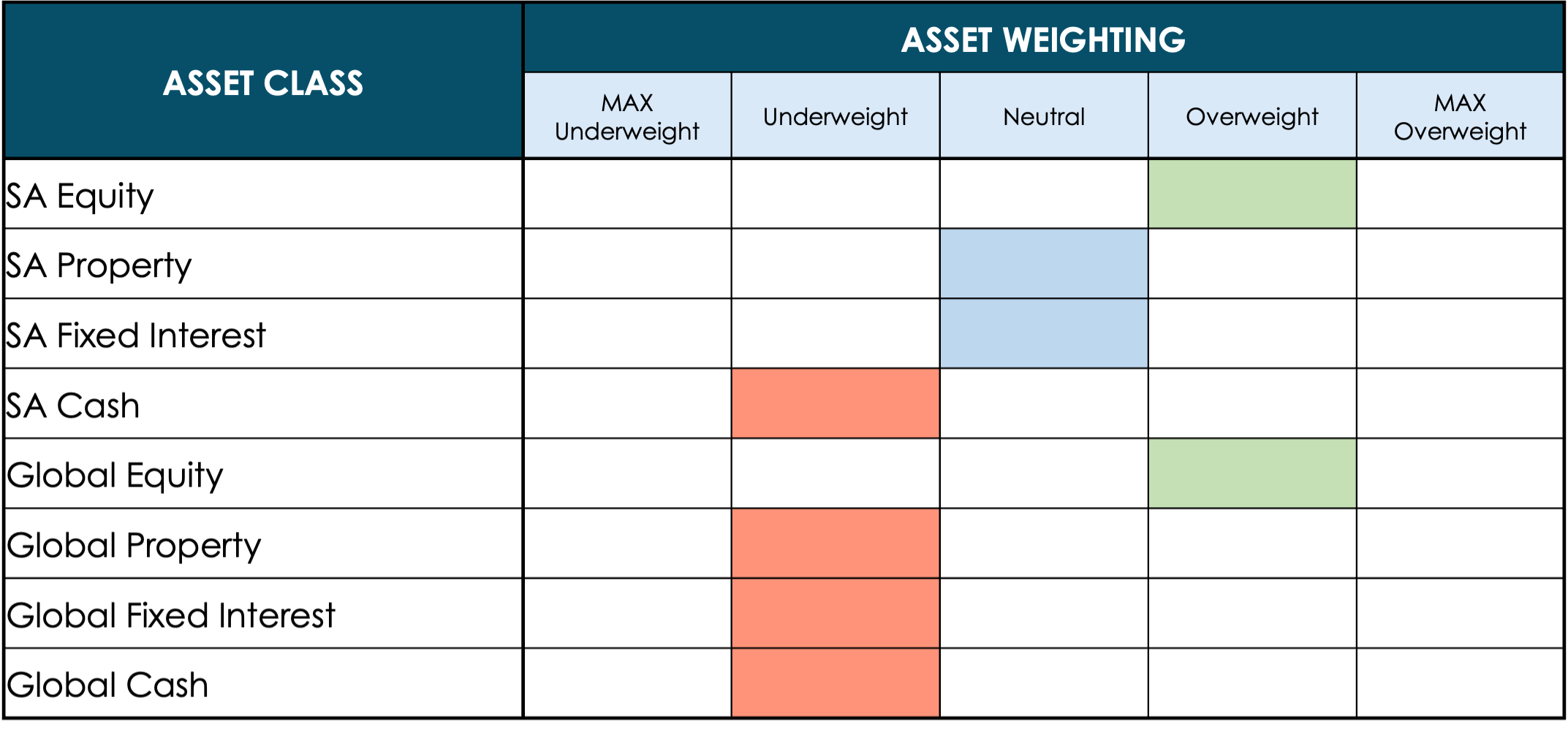

SA EQUITY

OVERWEIGHT – OUTPERFORMED | +12.88% (ZAR) / +16.27% (USD)

South African equities had a standout quarter, delivering 12.9% in ZAR and 16.3% in USD, outperforming most major global markets. The outperformance was broad-based, with cyclical sectors, financials, and industrials all contributing positively. Resource counters, which had lagged earlier in the year, staged a notable recovery as commodity prices stabilised and global demand for precious metals and energy commodities improved. Large-cap stocks such as Naspers and Prosus continued to drive performance due to their offshore exposure and participation in the global technology rally. Financial stocks benefitted from an improving domestic macroeconomic outlook and declining bond yields, which boosted valuations. Our overweight exposure to SA equity meant that portfolios fully participated in the upside while remaining balanced against potential volatility, contributing to the relative outperformance.

SA LISTED PROPERTY

NEUTRAL – OUTPERFORMED | +6.65% (ZAR) / +9.86% (USD)

South African listed property returned 6.7% in ZAR and 9.9% in USD, benefitting from a decline in long-term yields and an improvement in rental growth expectations. The sector’s rally was aided by a modest reduction in inflation and greater confidence that the SARB’s easing cycle would continue gradually. Although we maintained a neutral weighting, our emphasis on quality REITs with strong balance sheets, predictable income streams, and exposure to logistics and industrial property proved effective.

SA FIXED INTEREST

UNDERWEIGHT – OUTPERFORMED | +6.94% (ZAR) / +10.16% (USD)

The FTSE/JSE All Bond Index rose 6.9% in ZAR and 10.2% in USD, supported by falling yields across the curve and increased foreign demand for local debt. Our underweight positioning limited some upside participation, though duration management within the short-to-intermediate segment delivered strong returns. Bonds remain an important component of our diversification strategy, though the balance of risk and reward favors maintaining a defensive posture until more evidence of sustained fiscal discipline emerges.

SA CASH

OVERWEIGHT – NEUTRAL PERFORMANCE | +1.81% (ZAR) / +4.88% (USD)

Cash delivered a steady 1.8% in ZAR and 4.9% in USD, offering stability and liquidity during a quarter of strong risk-asset performance. Our overweight weighting in SA cash reflects its strategic role as both a volatility buffer and a source of dry powder for redeployment into attractive opportunities.

GLOBAL EQUITIES

OVERWEIGHT – NEUTRAL PERFORMANCE | +4.48% (ZAR) / +7.62% (USD)

Global equities delivered a solid 4.5% in ZAR and 7.6% in USD, extending year-to-date gains on the back of improving economic sentiment and continued enthusiasm around AI and technology-led growth. The S&P 500 gained 8.0% in USD, driven primarily by technology and communication services, while the MSCI World rose 7.3% and the MSCI Emerging Markets Index outperformed with a 10.6% USD return. Our overweight allocation in global equities positioned us well to benefit from these gains, particularly through active exposure to the US and Asian markets, with a focus on emerging market exposure going forward.

GLOBAL PROPERTY

UNDERWEIGHT – NEUTRAL PERFORMANCE | +1.45% (ZAR) / +4.50% (USD)

Global property markets posted modest gains of 1.5% in ZAR and 4.5% in USD, signaling a gradual recovery in investor confidence. Our underweight position reflected ongoing caution toward structural headwinds in the sector, particularly in commercial and office real estate.

GLOBAL FIXED INTEREST

UNDERWEIGHT – UNDERPERFORMED | -3.48% (ZAR) / -0.58% (USD)

Global bonds declined 3.5% in ZAR and 0.6% in USD, underperforming as yields remained volatile and credit spreads widened in some developed markets. Our underweight position proved advantageous, protecting portfolios from capital losses amid fluctuating inflation expectations.

GLOBAL CASH

UNDERWEIGHT – UNDERPERFORMED | -1.95% (ZAR) / +1.00% (USD)

Global cash produced -2.0% in ZAR and 1.0% in USD, offering stability in nominal terms but limited real returns after inflation. Our underweight weighting reflects the preference for higher-yielding alternatives such as global equities and selective bonds.

- Overweight / Neutral / Underweight indicates the MitonOptimal asset allocation views

- Outperformed / Neutral / Underperformed indicates the asset class performance over the quarter

Source of all data: Morningstar. Unless otherwise stated all local data is in ZAR and all offshore data is in USD.

DOWNLOAD: QUARTERLY MARKET INSIGHTS: Q3 2025

Jacques de Kock

Quantitative Analyst & Portfolio Manager

The content of this article is for information purposes only and does not constitute an offer or invitation to any person. The opinions expressed are subject to change and are not to be interpreted as investment advice. You should consult an adviser who will be able to provide appropriate advice that is based on your specific needs and circumstances. The information and opinions contained herein have been compiled or arrived at from sources believed to be reliable and given in good faith, but no representation is made as to their accuracy, completeness or correctness. MitonOptimal South Africa (Pty) Limited is an Authorised Financial Services Provider Licence No. 28160, regulated by the Financial Sector Conduct Authority (FSCA) – Registration No. 2005/032750/07.MitonOptimal Portfolio Management (Pty) Limited is an Authorised Financial Services Provider Licence No. 734, regulated by the FSCA – Registration No. 2000/000717/07.