WELCOME TO YOUR

SYGNIA SALES PORTAL

REPORTING

REQUEST HISTORICAL REPORTS

GLOBAL & SA MACRO OVERVIEW

PRACTICE MANAGEMENT

MitonOptimal requires a signed Service Level Agreement (SLA) with the adviser supporting the Sygnia model portfolios. Please provide the adviser’s information using the link below so that our team can follow up and put the SLA in place.

APPLICATION FORMS

MANDATE

DOWNLOAD: Latest Mandate

UPLOAD: Signed Mandate

SUBMIT: E-Mandate Request

WATCH: Mandate Training Video

FROM OUR INVESTMENT COMMITTEE

PORTFOLIO UPDATES

|

REGISTER FOR THE NEXT UPDATE HERE You will be able to register for the portfolio update webinar once it has been scheduled. |

WATCH: The latest update on the Sygnia portfolios You will be able to watch a recording of the latest portfolio update webinar here once it has taken place. |

MARKETING

QUARTERLY MARKET INSIGHTS | Q3 2025

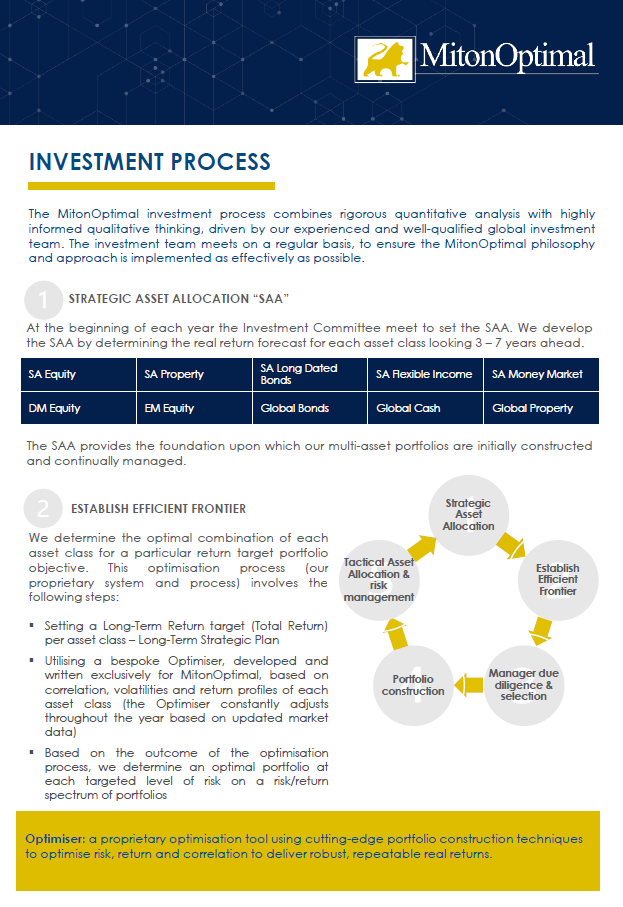

At MitonOptimal we take asset allocation (AA) very seriously, taking into consideration both Strategic AA (3-7 years) and Tactical AA within the various asset classes. This quarterly piece provides insight into our short term tactical calls on a 12-month view...

JANUARY 2026 | MARKET AND PORTFOLIO COMMENTARY

Global Market Overview Global markets began 2026 with a noticeably broader “risk-on” tone than we had become accustomed to in late 2025. While US equities still delivered positive returns, leadership was less concentrated, and the month’s “story” was as much about...

EDUCATION HUB

PORTFOLIO DEVIATION AND BEHAVIOURAL RISK – THE IMPORTANCE OF STICKING TO A LONG TERM PLAN

MitonOptimal is a specialist discretionary fund manager (DFM) with a 25-year track record of managing multi-asset, multi-manager portfolios in line with defined financial...

WHAT IS A HEDGE FUND

South African Hedge Funds are classified as Collective Investment Schemes and are regulated by the Financial Services Conduct Authority. Hedge funds aim to deliver absolute...

WHAT IS A DISCRETIONARY FUND MANAGER

Merriam-Webster defines the term discretionary as: “left to individual choice or judgement”. In the financial services world the terms discretionary management, discretionary...

GET IN TOUCH

CRM & NEW BUSINESS

IMPLEMENTATION

ONGOING SERVICES

SHANA ROBERTSON | Team Leader

FINANCE & FEES

MitonOptimal South Africa (Pty) Limited is an Authorised Financial Services Provider Licence No. 28160, regulated by the Financial Sector Conduct Authority (FSCA) - Registration No. 2005/032750/07.

MitonOptimal Portfolio Management (Pty) Limited is an Authorised Financial Services Provider Licence No. 734, regulated by the FSCA – Registration No. 2000/000717/07.

Great Westerford, Suite 202,

South Wing, 2nd Floor, 240 Main Road,

Rondebosch, 7700, South Africa

© 2026 MitonOptimal.

All rights reserved